The Congressional Budget Office (CBO) released a daunting report on the country’s economic health. They indicate that the U.S. federal debt could surge in the next decade…

CBO Finds Federal Debt to Rise to 115% of GDP in the Next Decade

The federal debt could rise to 115% of the country’s Gross Domestic Product (GDP). This forecast raised economic worries. Moreover, the situation calls for urgent action to address the fiscal imbalance.

The CBO’s report highlights the potential consequences of the surging federal debt. They believe that there would be significant implications for the nation’s economy. As the debt-to-GDP ratio approaches unprecedented levels, concerns mount about its:

- Impact on interest rates

- Inflation

- Overall economic stability

Experts warn that this mounting debt burden could prevent economic growth. Moreover, it can lead to:

- Reduced investments

- Negatively affect job prospects for many Americans

Amidst the growing concerns, policymakers face increasing pressure to find viable solutions. The report underscores the need for bipartisan cooperation to create strategies aimed at:

- Reducing deficits

- Curbing spending

Tough decisions lie ahead as the nation grapples with the delicate balance of maintaining critical services while ensuring fiscal responsibility for future generations…

The debate over tackling the surging federal debt intensifies. Now, both sides of the aisle must come together to:

- Find common ground

- Enact responsible fiscal policies

The fate of the country’s economic future hangs in the balance, making it essential for policymakers to act swiftly and decisively to address this pressing issue…

Federal Debt Explodes to $1 Trillion Since Suspending Debt Limit

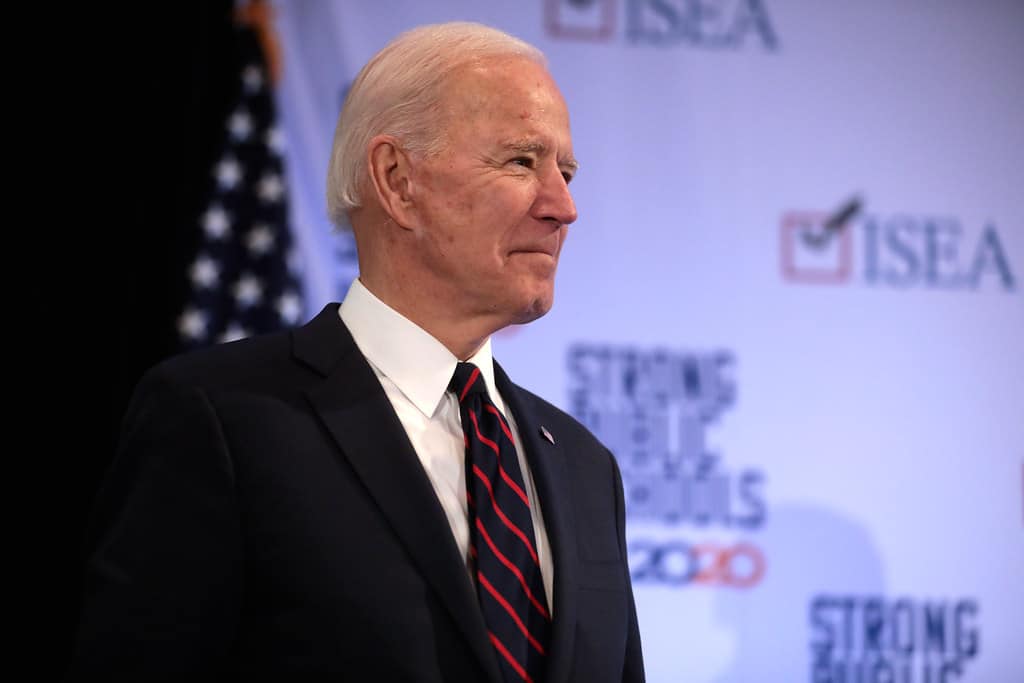

The U.S. national debt is likely to grow after President Biden signed the debt ceiling deal. Hence, there is now a significant increase in borrowing.

The nation’s debt continues to climb. Moreover, concerns about the long-term economic consequences are being raised by:

- Conservatives

- Fiscal hawks

With the debt ceiling deal in place, the country’s borrowing limit is far stretched. This decision would enable the government to meet its financial obligations without defaulting on debt…

However, this move has created debate among conservatives who argue that such a decision may worsen the debt crisis.

Critics of the deal argue that the growing national debt could lead to adverse effects on the economy, such as:

- Inflation

- Higher interest rates

They believe that increased borrowing without corresponding fiscal restraint could affect future generations with the burden of unsustainable debt…

Meanwhile, supporters of the debt ceiling deal contend that raising the borrowing limit was necessary to:

- Ensure the government continues its operations

- Fulfill its obligations

They argue that failure to raise the debt ceiling could have led to catastrophic consequences. Hence, it could negatively impact financial markets and jeopardize essential services.

As the national debt continues to rise, the political divide on addressing this pressing issue remains a significant challenge for policymakers…

Right now, policymakers need to do the following for the country’s long-term stability:

- Finding a balanced approach to managing the debt

- Promote economic growth while maintaining critical services

Conservatives and lawmakers will undoubtedly engage in rigorous discussions to find sustainable solutions to address the nation’s growing debt…